SAS Becomes Launch Airline for Digital Alliance Predictive Maintenance Tech

SAS Scandinavian Airlines has become the launch customer of the Skywise Predictive Maintenance (SPM) technology, “SPM Alliance,” provided by the Aviation Digital Alliance.

The Aviation Digital Alliance is a partnership first established in 2019 to combine the aircraft systems expertise of the maintenance division of Delta Air Lines with the flight data collection and cloud computing services of the Airbus Skywise platform. Last year, the partnership doubled the number of analytics algorithms as well as the number of aircraft parts that can be monitored by Skywise with the addition of GE Digital.

Now, SAS has signed an agreement that will integrate the SPM Alliance technology into its A320 family fleet, around 70 aircraft total.

Marko Rudic, Head of Technical Operations at SAS, said the Scandinavian carrier is ready to start using SPM’s “powerful analytics.”

“Thanks to SPM Alliance, we will be able to pre-empt operational disruptions and accelerate maintenance decisions by predicting potential in-service issues across our large A320 Family fleet,” he said in an April 26 press release. “This is the proactive approach to fleet technical management that SAS wants to take.”

Skywise, the aviation data platform launched by Airbus in 2017, provides the key digital infrastructure to the Alliance, as it provides a singular access point to data analytics that combine multiple sources into one secure cloud-based platform, including work orders, spares consumption, components data, aircraft/fleet configuration, onboard sensor data, and flight schedules. Airbus estimates that the cloud computing infrastructure—servers, based in Ireland—that hosts Skywise contains about 15 petabytes, or 15 million total gigabytes, of flight operational data points about individual in-service Airbus aircraft parts, systems, and engines.

While Skywise and the broader Digital Alliance platform with Delta TechOps and GE Digital collects data about other aircraft, licensing agreements with airlines keep Airbus from accessing data about non-Airbus aircraft.

“As airlines are on the path to recovery, it is more important than ever to support them in saving costs and optimizing their fleets’ availability,” Lionel Rouby, SVP Digital Solutions, Airbus, said in a statement. “This is precisely what SPM Alliance does: covering a wide scope of equipment, our new solution brings another dimension to predictive maintenance that will considerably reduce unplanned maintenance.”

Can Airbus Leverage Metaverse for Airline Passenger Experience?

On April 26, Airbus, the Toulouse, France-based commercial and military aircraft manufacturer, launched a new engineering design challenge involving the use of metaverse technology to improve the commercial airline passenger experience.

The design challenge has been launched under a partnership between Airbus and HeroX—the New York-based online crowdsourcing platform—and targets the use of augmented and virtual reality among other innovative new digital technologies to elevate the commercial air traveler experience from “departure to destination,” according to an April 26 press release. HeroX describes the Metaverse as “an embodiment of the internet as a virtual or digital world that is experienced through the use of digital tools, including augmented reality (AR) or virtual reality (VR).”

“Innovation is part of our DNA,” Marc Fischer, SVP Cabin and Cargo Engineering, Airbus, said in a statement. “We have a long history of pioneering new technologies. Metaverse is an unknown world and we’d like to understand how it can elevate our passengers’ experience. This challenge is a perfect start.”

As a company, HeroX describes itself as providing a platform where its clients, such as Airbus in this case, design challenges around problems they observe that need to be resolved. HeroX then provides an open marketplace where engineers, developers, artists, and project-specific applicants develop demonstrable solutions for the challenge proposed.

Guidelines provided by Airbus for the challenge note that the company is open to anything that “improves a passenger’s experience, whether your idea provides a new way to complete a task, increases accessibility, or offers a service that was previously not available.” Among the examples of passenger experience applications that could be elevated using metaverse technology include seat assignments, meals, and in-flight entertainment (IFE) options.

Other suggestions include metaverse-immersed in-flight gaming, helping disabled or injured passengers that have seat-accessibility issues, and collaborative social networking tools. The company is requiring applicants to provide a proof-of-concept with their submission such as a video walk-through or visualization tools such as story-boarding and animation.

“Airbus will recognize five winners with a total prize purse of $30,000,” the company writes in the challenge posting. “The team submitting the most compelling vision for how the metaverse can improve the passenger experience will win $10,000, and four other teams will win $5,000 each.”

Designers and developers have until June 14 to apply via the HeroX website, with winners scheduled to be announced on July 19, 2022.

Airbus Engineers Describe New Light Version of Airliner Satcom System

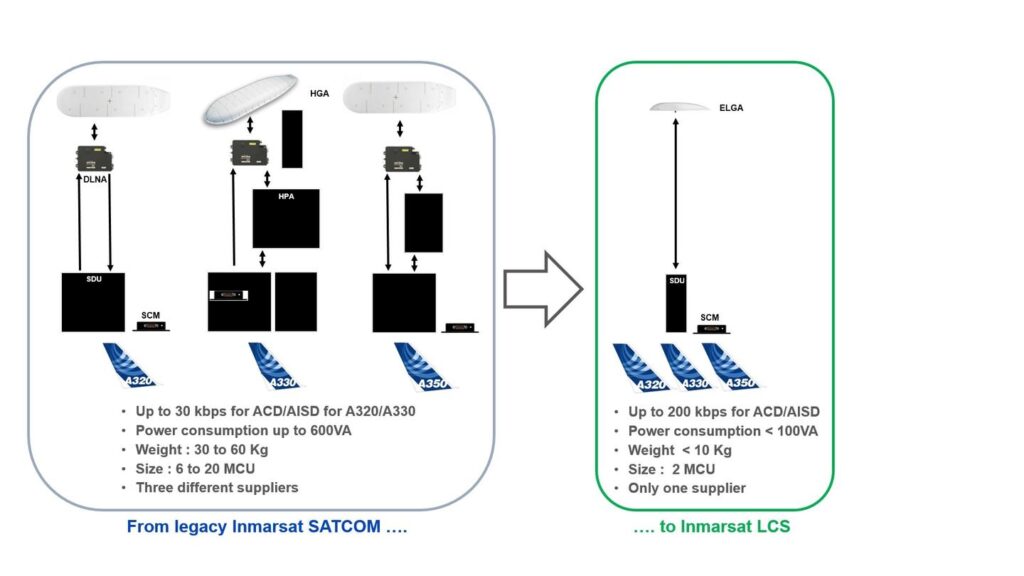

An article published by two Airbus engineers featured in the April edition of FAST Magazine, a technical publication distributed to Airbus customers, describes how the Toulouse, France-based commercial and military aircraft maker has lowered the footprint of an Inmarsat connectivity system for airlines operating the A320, A330 and eventually the A350.

Guillaume de Bony de Lavergne, a cockpit satcom work package leader and Rui Fernandes Dos Santos, a data link communications specialist—the two Airbus engineers that wrote the article—describe the new development as the Inmarsat Light Cockpit Satcom (LCS) system that replaces a previous generation version with more robust cockpit connectivity functionality provided by fewer individual components.

As a cockpit connectivity system, LCS is enabled by the “Inmarsat L-Band satellite constellation (today ensured by four I-4 satellites, to be complemented and superseded tomorrow by I-6 ELERA satellites network operating in geostationary orbit) using SB-Safety 2.0 services,” the article notes.

Compared to the previous generation system’s configuration of up to 20 master control units (MCU) weighing up to 60 kilograms (Kg) from three different suppliers, LCS requires two MCUs weighing less than 10 Kg from one supplier.

Flight crews also get up to 200 kilobits per second (Kbps) with LCS compared to 30 Kbps featured in the previous generation.

Jim Fawcett, a lead flight test engineer for Airbus, is quoted in the article, describing how his team evaluated the new system, stating,”To ensure good geographical coverage and correct voice and data service behaviour at satellite handover boundaries, we even operated our A350 on a 12-hour flight from Toulouse in France to Gander in Canada and back, without landing! Our crews found the HMI (Human Machine Interface) intuitive and easy to use. The system behaved well and should provide a secure solution for our customers in the years ahead.”

According to the article, several airlines have already started flying with the new LCS system on A320 and A330 family aircraft, while the system is scheduled to become available for airlines flying the A350 next year.

Viasat Achieves First In-Flight Connectivity Type Certification in China

Viasat has achieved the first type certification for its in-flight connectivity system in China on the Airbus A320.

The Civil Aviation Administration of China (CAAC) issued a Validation of Supplemental Type Certificate (VSTC) to the satellite operator for the installation of Ka-band satellite systems on Airbus A320s. Under the new VSTC, A320 operators based in China can modify their aircraft with Viasat’s antenna, radome, modem, server, and wireless access points (WAPs).

According to Viasat, the new VSTC was issued based on an Airbus A320 STC previously certified by the European Union Aviation Safety Agency (EASA). Xinhua, a Chinese media outlet managed by China’s government, in February published an update noting that Airbus plans to deliver the 600th A320 family aircraft assembled at its final assembly line in north China’s Tianjin Municipality this year.

Don Buchman, Viasat’s vice president and general manager, Commercial Aviation, called their first Chinese type certification “significant because Chinese-based airlines, using our best-in-class equipment, are now a step closer to delivering an on-the-ground internet experience to their passengers while in-flight. We’re grateful to our partners in China for their support and are committed to continuing to invest in this important market—where we have operated since 1994—for the long run.”

Viasat’s CAAC A320 type certification comes following a November agreement established with China Satellite Communications (China Satcom) that will allow the satellite operator to offer its Ka-band service to domestic and international airlines via the Ka-band ChinaSat-16 satellite system.

Alaska Airlines Taps Intelsat to Provide Flat Rate IFC Service on 105 Aircraft

Alaska Airlines is expanding its partnership with Intelsat to provide in-flight connectivity (IFC) on 105 of the company’s new fleet of Boeing 737MAX aircraft. Intelsat-equipped aircraft deliveries have already commenced and will continue through 2024 across Alaska Airlines’ new 737-9s.

The airline already operates Intelsat’s 2Ku IFC service on 150 aircraft, after first partnering with Gogo in 2010. Intelsat acquired the commercial aviation segment of Gogo in 2020. The deal announced Thursday is the largest expansion of the IFC relationship between the two companies to date.

Alaska Airlines said in its own release that the service will give guests better reliability, faster connections, and a lower cost. The company reported its web portal now loads 50% faster than before with a “one-click-to-connect” web experience, and connection speeds are 20 times faster than the previous, basic Wi-Fi system. The company also announced a new $8 flat rate for Wi-Fi service on mainline aircraft equipped with satellite-enabled connectivity.

“Alaska is committed to delivering a connected experience that gives their guests a high-speed internet service and high-quality content. I couldn’t be happier that they chose Intelsat as their partner,” said Dave Bijur, senior vice president of commercial in Intelsat’s commercial aviation division. “Our continuous launch of satellites over the next several years, starting with Intelsat 40e next year, puts us in a position to deliver reliability, redundancy and speed – all of which maximize guest satisfaction.”

SpaceX Enters In-flight Connectivity Services Market with Hawaiian, JSX Deals

SpaceX made its official entry into the in-flight connectivity (IFC) service provider marketplace this month, with JSX and Hawaiian Airlines subsequently announcing deals to use the company’s Starlink satellites on their aircraft.

Starlink is a constellation of satellites in Low-Earth Orbit (LEO) that provides broadband internet service in areas where terrestrial options are too expensive, unreliable, or unavailable. At the beginning of 2022, Via Satellite reported that Starlink serves more than 145,000 users in 25 countries and regions.

“Pretty fly for a WiFi. First antenna installed and testing. Rapid deployment once certification achieved,” Alex Wilcox, CEO of JSX, tweeted on April 22 to announce the California-based public charter air carrier’s new deal with SpaceX.

The majority of routes operated by JSX are between airports located in California and southwestern destinations, with a fleet of 77 total Embraer 135s and 145s. The JSX brand is a subsidiary of private charter JetSuite, and it focuses on providing short-haul flights at prices that compete with commercial airline business cabin fares. The company previously had committed to becoming the launch customer for the SmartSky Networks IFC service.

Jonathan Hofeller, who serves as vice president of SpaceX, has also discussed the company’s plans for in-flight connectivity services in several public appearances over the last year.

During a virtual appearance on a Connected Aviation Intelligence panel discussion about LEO satellite IFC for aviation services, Hofeller said the company has developed its own IFC terminal that leverages its phased array consumer antenna for aviation.

“High-speed, low-latency internet is critical in our modern age, and during air travel is no exception,” Hofeller said in a statement, commenting on the JSX agreement. “With Starlink, we’re able to provide an internet experience similar to or better than what passengers experience at home. We are creating a future that when all customers walk on to the plane, the internet just works – no hassles, no logins. By being the first air carrier to adopt Starlink, JSX is setting this new standard for air travel.”

Several days after the JSX announcement, Hawaiian Airlines unveiled its own new agreement with SpaceX to add Starlink connectivity to its fleet of Airbus A330 and A321neo aircraft, as well as the Boeing 787-9s it currently has on order.

Hawaiian’s fleet of Boeing 717s that operate shorter inter-island flights will not be equipped with Starlink IFC terminals. According to the airline’s 2021 annual report filing, Hawaiian’s in-service fleet consists of 24 total A330-200s and 18 A321neos, with 10 total 787-9s on order under a 2018 purchase agreement with Boeing.

Peter Ingram, CEO of Hawaiian Airlines, discussed the Starlink agreement during the company’s first quarter earnings call, held on April 26, noting that the Starlink IFC speeds will “support fast web browsing and streaming that we’ve gotten used to on our devices on the ground.”

Ingram expects aircraft modifications for the new service to begin next year, and will have more details about when the first Starlink IFC-equipped passenger carrying flight will occur later this year. “We will be deploying it with a simple interface and free of charge to all our guests for however many devices they are accessing on board. We have deliberately trailed the industry in deploying in-flight connectivity because current and previous generations of products perform below our standards over the Pacific, where most of our time in-flight is spent,” he said. “Until now there was no offering that provided a superior product to match the rest of our in-flight experience. Starlink changes this, and we think our guests will be delighted when they have the chance to experience it.”

Sun Country Chief Marketing Officer Confirmed as Keynote Speaker at CAI 2022

Brian Davis, the Chief Marketing Officer of Sun Country Airlines, has been confirmed as the opening keynote speaker for the third day of the 2022 Connected Aviation Intelligence Summit.

Brian was appointed Sun Country’s Chief Marketing Officer in January 2018. He previously served as Special Advisor on Business Strategy to Wingo, a subsidiary of Copa Airlines, and Adjunct Professor of Marketing and PR at California State University – Los Angeles. From 2005 to 2017, Brian served in several leadership roles at Allegiant Air, including Vice President of Marketing and Sales. He holds a Master of Business Administration from The Wharton School.

Davis provided some perspective on low cost airline investment in in-flight connectivity equipment and service last year to Avionics International, one of the two publications behind the Connected Aviation Intelligence Summit. Check out his interview here, and be sure to register for this year’s Connected Aviation Intelligence Summit to see his keynote speech live!

SmartSky Networks Partners with Mosaic ATM, Expanding Skytelligence

SmartSky’s Skytelligence platform for in-flight connectivity applications now counts Mosaic ATM as a partner, adding new data streams, data processing and fusion techniques.

The partnership with Mosaic ATM enhances Skytelligence’s framework infrastructure connecting aviation applications and services developers, expanding the capabilities of the platform and allowing for the development of applications that integrate more data sources.

SmartSky’s Skytelligence platform for in-flight connectivity applications now counts Mosaic ATM as a partner, adding new data streams, data processing and fusion techniques.

The partnership with Mosaic ATM enhances Skytelligence’s framework infrastructure connecting aviation applications and services developers, expanding the capabilities of the platform and allowing for the development of applications that integrate more data sources.

|

Want to hear more on aircraft connectivity applications? Check out the Global Connected Aircraft Podcast, where Avionics editor-in-chief Woodrow Bellamy III interviews airlines on how they’re applying connectivity solutions. |

When it Comes to Antennas, it’s All About Price

Editorial Note: This article first appeared in August 2019 edition of Via Satellite.

Editorial Note: This article first appeared in August 2019 edition of Via Satellite.

With the proliferation of satellites in Non-Geostationary Orbits (NGSO), and the growing capacity and coverage of Geostationary Orbit (GEO) satellites, antenna manufacturers must continuously adapt. New specifications demand new technologies, in an exciting age where network coverage is reaching new possibilities.

In order to support the upcoming wave of multi-satellite constellations that demand different coverage, transmission power, and frequency bands, these companies must also continue to innovate, at a reasonable pricepoint. Via Satellite spoke to a handful of experts from Ball Aerospace, Kymeta, L3Harris, OneWeb, Panasonic Avionics, and ThinKom about new antenna technologies, potential breakthroughs, and where they see this industry segment headed in an environment where cost rules the realm of possibilities.

One could assume that antennas are evolving to get smaller and cheaper, as is the case with satellites. Spoiler alert — general consensus is that smaller isn’t necessarily better, and size and cost aren’t necessarily correlated — but cost savings are top of mind. Instead of thinking about antennas as “smaller is better,” it’s all about getting the best performance in the smallest possible area.

“It’s really about area efficiency,” comments ThinKom Chairman and CTO Bill Milroy. “In terms of cost, there is indeed a strong push to lower costs at much higher production rates and volumes, particularly for fixed User Terminals (UTs) in support of the various Low-Earth Orbit (LEO) and Medium-Earth Orbit (MEO) constellation players. In many cases, the cost of the antenna/terminal can (eventually will) make-or-break many of the best laid [business plans] for these constellations.”

As far as antennas used in In-Flight Connectivity (IFC), Panasonic Avionics Director of Connectivity, Technical Sales Lisa Kuo says that “the trend, as far as our [aircraft] customers, is to get as low profile as possible … Smaller may not be the right way to put it, but they want antennas to be as low profile as possible.”

But, cost is also top of mind. “A lot of times, getting smaller usually means getting cheaper. But for aircraft, they have very different constraints about what they’d like to see on the aircraft. One of the biggest questions they have is: How much times does it take to install the antenna? And then, how much time does it take to fix the antenna? If the antenna onboard is broken, how much downtime are they going to suffer in order to fix the antenna? And, how often is it broken? … We’re going to see an interesting case of cheaper antennas, versus more expensive antennas that are easy to install/antennas that don’t break as much,” she says.

Kuo sees antenna manufacturing going in two different directions. She says that companies could “give you antennas that aren’t as reliable, but they’re so cheap that you don’t care,” or there will be antenna providers that may “be a lot more expensive, but you install it one time, and you’ll never have to take it off for repair.”

L3Harris Director of Space Antennas and Structures Tom Campbell speaks to the space segment, in saying that “satellites are getting smaller, requiring the launch configuration of antennas to be more compact. This allows ride sharing on launches and enables constellations to be put in orbit at lower cost.”

It all comes full circle – with satellites getting smaller, antennas intended for launch must undergo a size reduction. But aside from size, there’s no doubt that cost is a big part of the equation, and Campbell adds that system designers are spending more time and effort on antennas to increase capabilities, while decreasing overall costs.

“They are finding that if they increase the capability of the space antenna, they are able to decrease the overall dollar/bit of the system,” Campbell says. “In most cases this is leading to increased quantities and higher gain antennas combined with frequency reuse strategies to maximize the throughput on the satellite.”

Kymeta Vice President of Product Lilac Muller stitches the ground and space segments together, in saying that, “antenna size is an interdependence of efficiency of both sides of the link.” She adds, “many antennas are expected to remain about the same size, given that they must be compatible with spacecraft that are currently in operation and ones that are still being designed. Price is a function of volume and integration. Price will increase or stay the same for markets that need very custom solutions and will decline for markets that enjoy the benefits of scale.”

Muller explains that the evolution in size and cost depends on the market verticals these antennas are serving. OneWeb Product Management Director Mirna Mekic adds, “there are market verticals, which will significantly benefit from the flat panel design — such as commercial and business jet aero applications, as those antenna designs provide significant OpEx savings in the airline industry.”

In the same vein, Kymeta’s Muller believes that a breakthrough on the horizon is being able to manufacture flat panel antennas in volume, specifically for LEO applications.

Speaking of the variations in antenna design, Electronically Steerable Antennas (ESA) are clearly a hot item. Ball Aerospace Vice President and General Manager Rob Freeman stresses how the greater satcom industry has been waiting for two things from ESAs. “First, fully electronically-steerable phased array antennas that work. Electronically-steerable antennas are flat panel antennas that have no moving parts and are software configured,” he says. “Second, the satcom industry has looking for fully electronically steerable phased array antennas that are affordable. In other words, customers want performance at the right price points.”

ESA is specifically of value to the In-Flight Connectivity (IFC) arena, as noted by Kuo— she believes that the ESA antenna is the next big breakthrough for the aviation segment.

“For IFC, a lot of people believe the ESA antenna is the next big thing,” she says. “There’s definitely a good reason for that, with the rise of LEO and NGSO constellations — it makes ESA antennas a lot more technically feasible. Because we’re also focusing on the lower antenna profiles with higher reliability, ESA antennas have a lot of really good features that meet all these trends.”

In terms of form factor, Kuo believes that mobile antennas will eventually become part of the vehicles they support. “Another thing is expanding ESA to a bigger scale — having an antenna that is embedded entirely in the aircraft body,” she says. “I believe that at some point, aircraft manufacturers, Original Equipment Manufacturers (OEMs), will start embracing that. I remember when 10 years ago, GPS didn’t come standard in a car. You had to order units separately. But nowadays, it’s silly for a car not to have GPS — it’s part of what you have to have in the car. I’m sure antennas will become something like that on the aircraft. So, it’s only a matter of time before it becomes an essential part of the aircraft. I’m definitely looking forward to aircraft manufacturers to embed it as part of their permanent structure.”

Although some see ESA antennas being the next big breakthrough, Kymeta’s Muller generally believes that the next breakthrough is “more capable and feature rich antenna products, higher integration of the terminal to reduce cost and complexity, and more standardized configurations to support high volume emerging markets.”

Muller then delves into antenna applications in the connected vehicle market. “Land mobility has traditionally been a communications-on-the-pause market or required an expensive solution for military or high-end applications,” she says. “We have opened and will continue to open the land mobility market to more opportunities to solve business needs with our next-generation terminal product. The components available in the satellite industry have not been built to the grade necessary for automotive environments and we are working to bridge that gap.”

“Kymeta identified a market problem for connectivity as it relates to the automotive sector which has only increased with the shift to autonomous driving,” Muller continues. “The need is clear for contiguous communications for a connected and autonomous future. This applies to both on-road, off-road and industrial applications in the automotive market. We are developing a full, integrated solution to address the needs of this emerging market. That solution will incorporate both satellite and cellular connectivity and related subscription services into a unified product offering targeted at these markets.”

The automotive vertical clearly agrees with the aviation segment in that a fully embedded connected car or aircraft has not been developed yet, but Muller adds that “the need for this kind of solution in the industry is here and now.”

Although technology development continues to steer itself in different directions — and often dependent on the market vertical — multiband antennas continue to be a sought-after pipedream for many. Fortunately, the consensus is that the technology is plausible.

“Multiband antennas are plausible but not yet practical,” according to Ball Aerospace’s Freeman. “For the foreseeable future, the end user will need to sacrifice performance and deal with higher cost if they require a single antenna system operating over multiple satellite bands (i.e. Ku- and Ka-band). “

OneWeb’s Mekic further adds that the plausibility of multiband antennas depends on the market, and the antenna’s intended applications. “We are seeing examples of technology maturity which will enable multi-band antenna designs,” she says. “The application of those antenna designs will depend on the needs and requirements of the customer and end-users. You can expect end-users to want to see a value in the antenna they chose, which balances connectivity and service flexibility with design parameters such as — power consumption, size/profile, and ultimately the price.”

Panasonic’s Kuo brings the discussion back to aviation. “This is a highly contested topic in the land of IFC, especially for Panasonic. At this point, we are offering a Ku-band solution, and we are also offering a Ka-band solution to our airline customers. When we look at our antenna roadmap as well as the features we are planning on embedding in our roadmap, we talk amongst ourselves and say: ‘Hey, what about a Ku-/Ka- band antenna that allows you to do either Ku- or Ka- band?’ That is a really attractive thought, but when you look at the technology we have today — in order to make a Ku-/Ka- band antenna, the efficiency is not there, and the size is also not there. Our customers are looking for smaller and flatter — not heavier, bigger, and bulkier,” she says. “That’s not to say that in the future we won’t get there, but we still haven’t seen it yet.”

The antenna market has seen a lot of technological growth, but as with anything, there is still a long way ahead. Whether it’s the aviation or connected vehicle markets waiting for a time where antennas can be installed in the entirety of the aircraft/vehicle, or others simply waiting for a practical multiband antenna, markets continue to seek prices that are right for both suppliers and customers.

Airbus A220 Gets New Iridium Satcom Option

The Airbus A220, pictured here, preparing for a demo flight at Chubu International Airport in Japan, has a new Iridium satcom option. Photo: Airbus